1. What is Volatility? How is it Measured? An Overview of the VIX Index

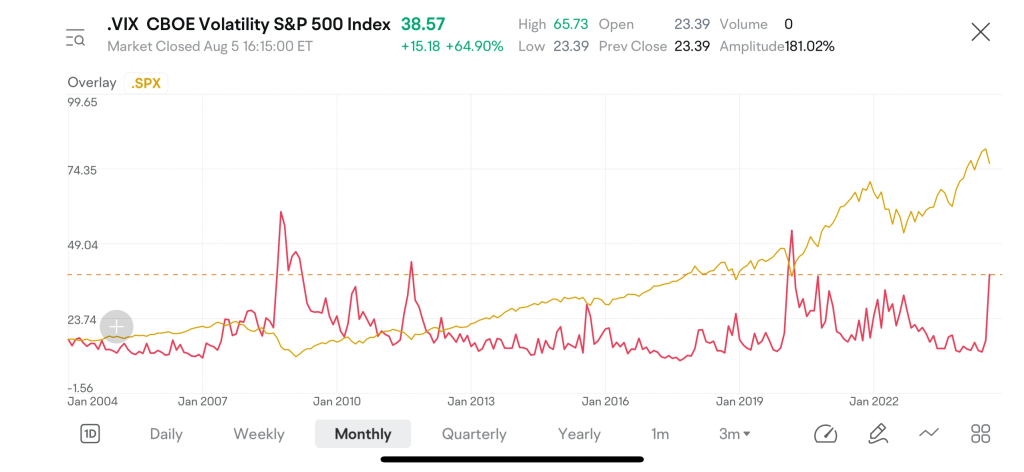

In mid-July 2024, the U.S. stock market was thriving, with major indices reaching record highs. However, within a month, everything changed. The first three trading days of August delivered a “triple blow,” as both the S&P 500 and NASDAQ plummeted. At the same time, the VIX index—known as the “fear index”—surged by an astonishing 108%. But what exactly is the VIX, why is it significant, and how can investors profit from market volatility?

The VIX Index (often called the fear index) is one of the most closely watched volatility indicators, introduced by the Chicago Board Options Exchange (CBOE). It measures the implied volatility of the S&P 500 over the next 30 days. The VIX generally moves inversely to market sentiment—when anxiety rises, the VIX increases; when the market stabilizes, the VIX declines. The VIX value is expressed as an annualized percentage. For instance, a VIX level of 17 implies an expected annualized volatility of 17%, which equates to a 4.9% expected monthly movement (17% ÷ √12 = 4.9%).

In the U.S. market, volatility represents the magnitude and frequency of price changes. A higher VIX suggests that investors anticipate larger future price swings. However, a rising VIX doesn’t always signal a market downturn. While an increasing VIX typically reflects negative sentiment, a declining VIX is often associated with market recovery.

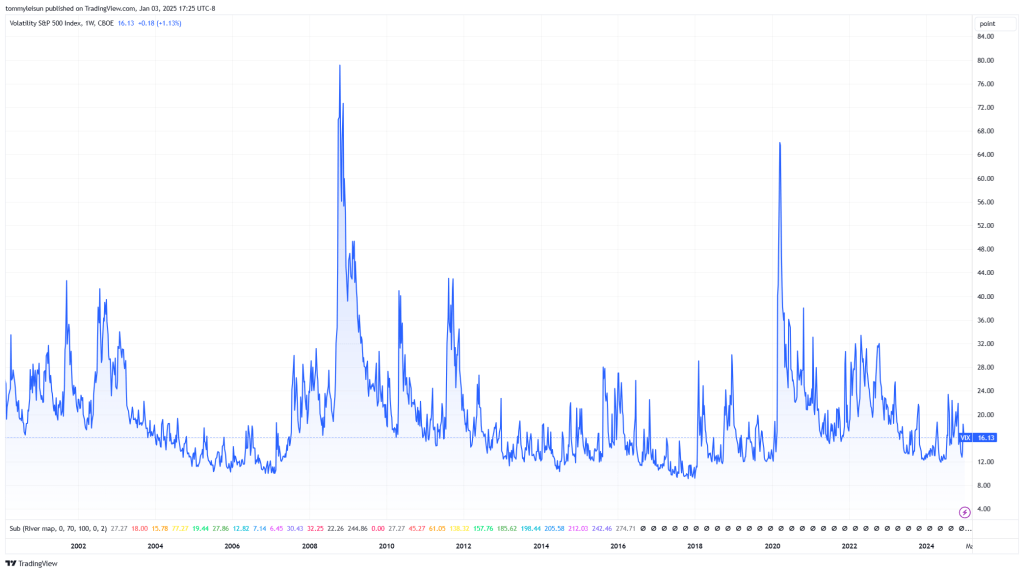

For example, during the 2008 Global Financial Crisis, the S&P 500 plunged over 40%, while the VIX soared above 80, reflecting extreme panic. Conversely, after the 2021 vaccine rollout, the U.S. stock market stabilized, and the VIX dropped below 20, signaling calmer conditions.

2. Volatility Trends: Why Can You Profit from Volatility?

Volatility follows predictable patterns:

- Mean Reversion: Volatility tends to revert to a long-term average. Extreme highs or lows often stabilize over time.

- Asymmetry: The U.S. market tends to decline faster and more sharply than it rises, causing the VIX to spike during downturns and decrease slowly during rallies.

- Risk Premium: Investors typically pay a premium for options to hedge against risk, which keeps implied volatility higher than realized volatility.

Since volatility tends to move according to these patterns, investors can use volatility derivatives to capitalize on situations where volatility is either too high or too low. For example, when the market is gripped by excessive fear and volatility is elevated, shorting volatility offers profit opportunities. Conversely, during calm markets with potential risk events, going long on volatility products can deliver significant returns.

The VIX fear index also provides valuable insight into the broader market and individual stocks. When the VIX rises, it indicates heightened market anxiety. Sharp increases typically point to major disruptions such as wars, financial crises, or natural disasters, often leading to swift market declines. During these times, panic selling is common, but value investors may view these events as “buying opportunities” and follow the principle of “be greedy when others are fearful.” On the other hand, when the VIX declines and remains low, it signals market stability and overall optimism, although it may also lead to investor complacency.

Historically, the VIX has ranged between 10 and 30. Analysts often use 30 as a benchmark for high volatility and market fear. A VIX below 20 usually indicates market stability, while a VIX below 15 may suggest a market bubble.

3. How to Go Long on Volatility

VXX and UVXY Strategy Examples

Going long on volatility involves profiting from expected market turbulence, usually in anticipation of significant events or declines in the U.S. market.

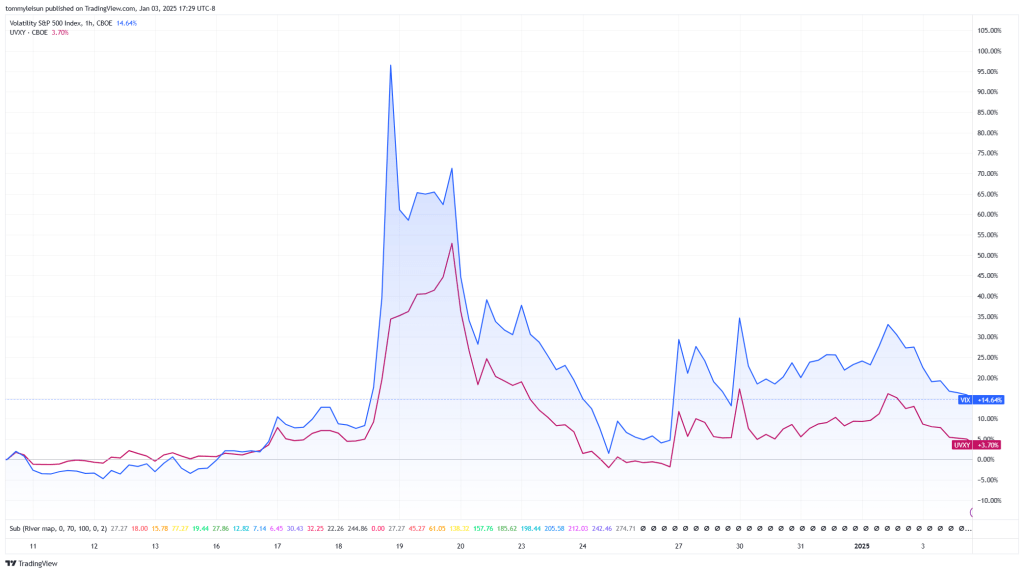

- Buying VIX ETFs/ETNs: Products like VXX and UVXY track VIX futures. When the VIX rises, these ETFs increase in value. For example, buying UVXY can provide leveraged returns during market disruptions.

- Buying Put Options: Purchasing put options on major indices can lead to profits as volatility increases and option premiums rise.

Steps to Implement:

- Identify potential risk events (e.g., earnings reports, economic data releases).

- Choose appropriate VIX-related products or options contracts.

- Set clear stop-loss and take-profit levels.

4. How to Short Volatility

Shorting volatility involves profiting from declining market turbulence, which is ideal in calm markets.

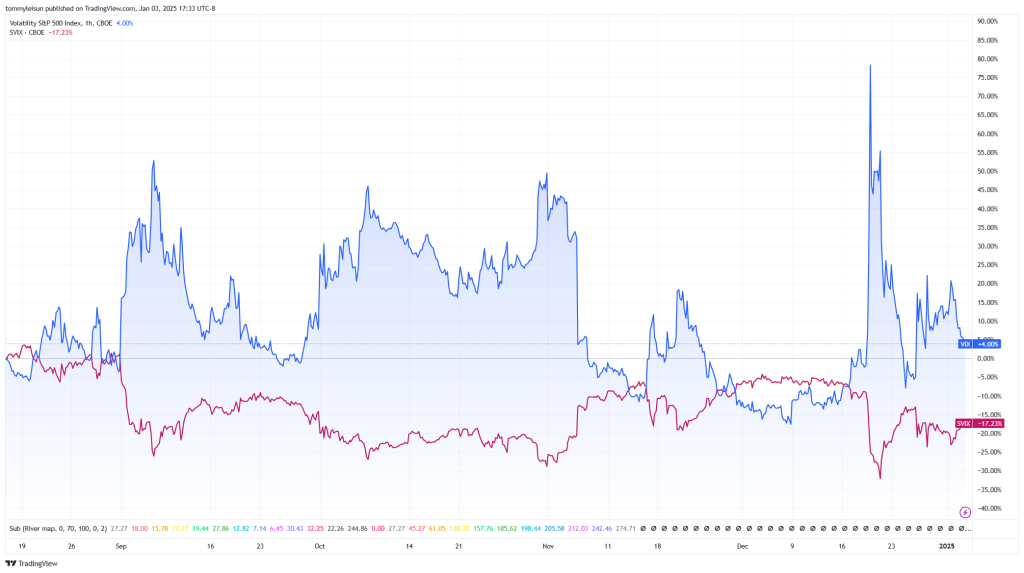

- Buying Inverse VIX ETFs: Products like SVIX short VIX futures and generate returns when volatility declines.

- Selling Call Options: Selling call options provides premium income if the market is unlikely to rally.

Steps to Implement:

- Evaluate if the VIX is at a high level with room to decline.

- Choose a suitable ETF or option strategy based on market conditions.

- Monitor volatility and adjust positions accordingly.

5. Long vs. Short Volatility: Which is Better?

| Strategy | Market Conditions | Risk | Return Potential |

|---|---|---|---|

| Long Volatility | High-risk events | High | High |

| Short Volatility | Stable market | Medium | Steady |

For most individual investors, shorting volatility is generally easier than going long. This is because it’s difficult to predict when a black swan event will cause volatility to spike, but it’s often possible to seize the opportunity to short volatility after a spike and profit from its decline.

If market direction is uncertain in your mind, multi-leg option strategies can be useful:

- Straddle Strategy: Simultaneously buy call and put options at the same strike price to profit from large market moves.

- Iron Condor Strategy: Sell a range of call and put options with hedges to profit from market stability while limiting losses.

6. Risk Considerations

Effective risk management is crucial in volatility trading. Common risks include:

- Market Volatility Risk: Prices can fluctuate drastically during major events.

- Leverage Risk: Leveraged ETFs and options amplify both gains and losses.

- Expiration Mismatch Risk: Futures and options contracts may have different expiration dates, impacting returns.

- Liquidity Risk: Bid-ask spreads may widen during extreme volatility, making it harder to exit positions.

7. Essential Knowledge for Investors

To manage these risks effectively, investors should understand:

- Derivatives Basics: Know how options and futures work.

- Volatility Metrics: Learn to interpret the VIX and implied volatility.

- Risk Management: Set appropriate stop-loss and take-profit points.

- Market History Analysis: Review past market events and their impact on volatility.

- Real-Time Market Monitoring: Stay updated with market news and economic releases.

By setting clear targets, maintaining proper position sizes, and closely monitoring trends, investors can navigate volatility trading with greater confidence.

Implementing strategies such as “U.S. market volatility trading techniques” and “low-risk income strategies” can further enhance trading success. Remaining disciplined and adaptive to changing market conditions is key to long-term growth.