Earn a Risk-Free 4.8% Return on Idle Cash in Your Investment Account.

In every investment account, there is often some idle cash sitting unutilized. This is especially true for TFSA accounts, where cash may be set aside, waiting for the right market opportunity. In investing, every dollar should have the potential to generate value. However, many investors overlook the importance of managing idle cash. This idle cash could come from unrealized gains, dividends, or funds awaiting allocation. If not effectively utilized, you might miss out on significant wealth growth. This article explores how you can maximize idle cash in your investment account, earning returns much higher than regular bank interest while maintaining flexibility.

The Growth Potential of Idle Cash

Consider an example of a CAD 100,000 investment account where 30% of the portfolio, on average, remains in cash to support a dollar-cost averaging strategy or to receive dividends. If this idle cash earns an annual return of 4.8%, the calculation would be as follows:

100,000×30%×4.8%=1,440 CAD

Although CAD 1,440 may not seem substantial initially, investing is a long-term endeavor. By managing and maximizing the use of idle cash over 10 years, you could earn an additional CAD 14,400.

Effective Strategies to Utilize Idle Cash in Your Investment Account

To ensure your idle cash works harder for you, consider the following investment options:

| Type | GIC (Guaranteed Investment Certificate) | High-Interest Bank Products (e.g., BMO’s BMT134) | High-Interest Savings ETFs (e.g., CASH.TO, PSA.TO) |

|---|---|---|---|

| Yield Range | High (~4.0%) | Medium (~3%) | High (4.5%+) |

| Return Type | Fixed rate | Floating rate (depends on bank policy) | Floating rate (linked to market interest rates) |

| Distribution Frequency | One-time payment at maturity | Monthly or quarterly payouts | Monthly distributions |

| Liquidity | Low (fixed term, early withdrawal may incur penalties) | Medium (flexible withdrawals, may have minimum deposit requirements) | High (daily tradable, no lock-up period) |

| Minimum Investment | Usually CAD 1,000 | Usually CAD 1,000 | No minimum required |

| Advantages | Stable, risk-free returns | Flexible, slightly higher return than regular savings accounts | High liquidity, easy to trade, and stable returns |

Why High-Interest Savings ETFs Are Ideal for Idle Cash

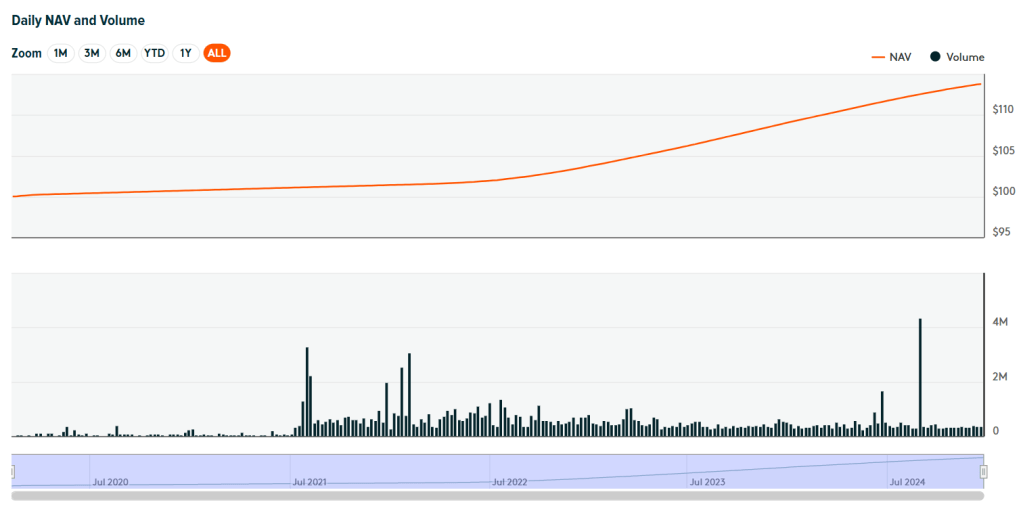

Among these options, high-interest savings ETFs (HISA ETFs) stand out as a top choice for earning returns on idle cash within your investment account. In Canada, notable HISA ETFs include:

| ETF Name | 2024 Yield | Payout Frequency | Management Expense Ratio (MER) | Assets Under Management (AUM) | Issuer |

|---|---|---|---|---|---|

| PSA.TO | 4.60% | Monthly | 0.15% | CAD 4.5B | Purpose Investments |

| CASH.TO | 4.53% | Monthly | 0.11% | CAD 5.4B | Global X Investments |

| MNY.TO | 4.81% | Monthly | 0.22% | CAD 1.3B | Purpose Investments |

| CSAV.TO | 4.51% | Monthly | 0.14% | CAD 6.36B | CI Global Asset Management |

Notes:

- Yield: The 2024 annualized return rate. This yield is subject to change and reflects current market rates.

- Payout Frequency: Indicates how often returns or distributions are paid out.

- Management Expense Ratio (MER): Represents the annual fee deducted from the ETF’s assets. Lower MERs help maximize net returns.

- AUM: The total value of assets managed by the ETF. A higher AUM usually signals greater liquidity and market acceptance.

- Issuer: The company managing and operating the ETF.

Practical Considerations When Investing in HISA ETFs

Since HISA ETFs are traded on exchanges, transaction costs must be taken into account. Here are some key points for different trading platforms:

- BMO InvestorLine: Each trade incurs a CAD $10 fee. For BMO clients, using their high-interest products (like BMT) can avoid trading fees, though the returns may be slightly lower.

- Interactive Brokers (IBKR): Transaction fees are around CAD $1 per trade. As long as you avoid frequent small trades, this remains cost-effective.

- Wealthsimple Trade: With zero trading fees, you can trade HISA ETFs as frequently as needed without worrying about fees eroding your returns.

If you don’t have a Wealthsimple account yet, you can sign up using this referral link to receive a CAD $25 bonus:

Let’s both get CAD 25 when you fund a Wealthsimple account. Use my referral code: EG5JMW. T&Cs apply. Click here to apply for a Wealthsimple account and receive your CAD $25 bonus.

Risks to Consider

HISA ETFs invest in high-interest deposit accounts held with Canada’s chartered banks. These products have minimal credit and liquidity risk. However, during extreme market conditions, the bid-ask spreads may widen slightly.

By leveraging the right tools, you can make idle cash in your investment account work smarter, ensuring that every dollar contributes to your long-term financial goals.