Real estate has always been a preferred choice for investors seeking stable returns and long-term appreciation. However, directly purchasing property—especially in global first-tier cities like Shanghai, Beijing, Toronto, Vancouver, or New York—usually requires a significant amount of capital. For most individual investors, this means taking on burdensome mortgages that can last decades. Commercial real estate is even more inaccessible for ordinary investors.

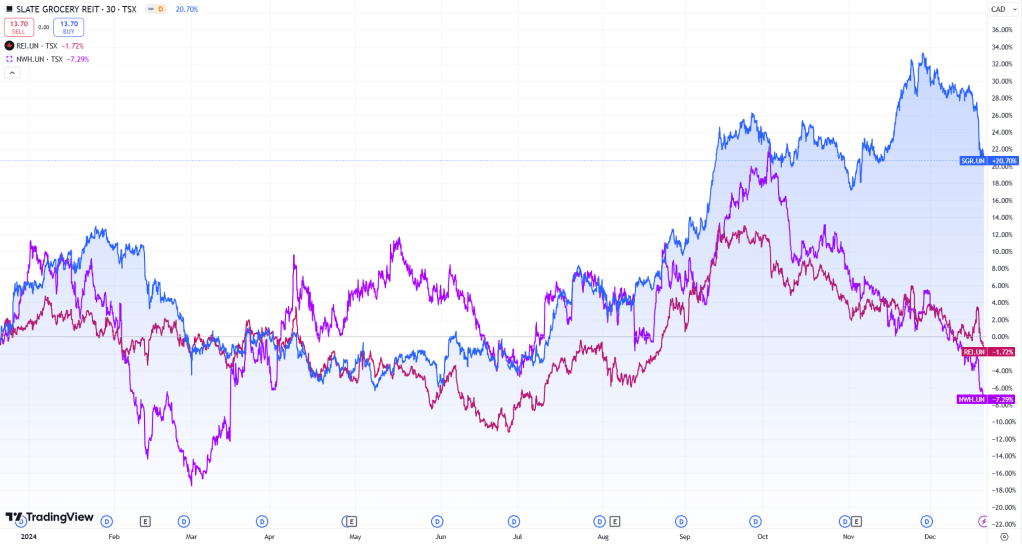

Fortunately, Real Estate Investment Trusts (REITs) offer a low-barrier way to invest in real estate, allowing small amounts of capital to participate in the growth and returns of the real estate market. This article will explain how REITs work, how they help investors generate income, and analyze the advantages and risks of three major Canadian REITs: RioCan REIT, Slate Grocery REIT, and NorthWest Healthcare Properties REIT.

What Are REITs, and How Do They Work?

A Real Estate Investment Trust (REIT) is a financial tool that pools funds from investors. These funds are managed by professional institutions to acquire and operate real estate assets, and the rental income is distributed to the investors. REITs allow investors to indirectly own a portion of real estate and benefit from stable rental income and asset appreciation.

Under trust management agreements, REITs typically distribute over 90% of their after-tax net income to investors as dividends.

Sources of Income for REITs

- Rental Income: The primary source of income for REITs is the rent generated from commercial properties, residential units, and other real estate holdings.

- Asset Appreciation: As the value of real estate properties increases, the Net Asset Value (NAV) of the REIT also grows.

Advantages of REITs

- Low Investment Threshold: No need for significant capital; even small amounts can be used to participate in real estate investments.

- High Dividends: Regular dividend payouts provide stable cash flow, often ranging from 5% to 12% annually.

- High Liquidity: Unlike direct real estate transactions, REITs can be traded freely on stock exchanges, just like stocks.

Three Major Canadian REITs

The Canadian market offers a wide variety of REITs covering multiple real estate sub-sectors and regions. Real estate markets are influenced by factors like interest rates, economic conditions, and policy changes. Before purchasing REITs, investors should understand the specific holdings and investment strategies of each REIT and consider their own risk tolerance. This article reflects personal views and does not constitute investment advice.

1. RioCan Real Estate Investment Trust (TSX: REI.UN)

As one of the largest REITs in Canada, RioCan primarily invests in retail and mixed-use properties, including shopping centers, warehouses, and commercial-residential complexes.

- High Occupancy Rate: As of Q3 2024, RioCan reported a commercial property occupancy rate of 97.8%.

- Rental Growth Potential: New lease agreements have seen rent increases of approximately 24.2%, and renewed leases have experienced a 12.6% rise.

- Stable Dividends: Currently offering a dividend yield of 5.9%, which is attractive for investors seeking stable cash flow.

- Property Distribution: Over 57.6% of assets are located in the Greater Toronto Area, with the rest distributed across other major Canadian cities like Quebec, Calgary, and Vancouver.

2. Slate Grocery REIT (TSX: SGR.UN)

This REIT focuses on grocery-anchored retail properties in the United States, with its tenants being large, indispensable supermarkets.

- Defensive Assets: By focusing on grocery-anchored retail properties, which have stable demand, Slate REIT demonstrates resilience to economic cycles.

- High Dividend Yield: Currently offering a monthly dividend of $0.10155 (as of November 2024), making it highly attractive to passive income investors.

- Rental Growth Potential: With an average rent of $12.61 per square foot, below the U.S. market average, there is room for future rent increases.

- Property Distribution: Properties are spread across multiple U.S. states, primarily in the Eastern and Midwestern regions.

3. NorthWest Healthcare Properties REIT (TSX: NWH.UN)

This REIT specializes in healthcare-related real estate globally, such as hospitals and clinics.

- Global Diversification: Its portfolio includes medical facilities across multiple countries, reducing the impact of regional economic fluctuations.

- Long-Term Leases: Extended lease terms ensure stable rental income.

- Economic Resilience: Demand for healthcare properties remains stable and is less influenced by economic cycles.

- Property Distribution: Assets are mainly located in North America, Europe, and the Asia-Pacific region, reflecting a diversified international investment approach.

Comparison of Key Metrics

| Indicator | RioCan REIT | Slate Grocery REIT | NorthWest Healthcare REIT |

|---|---|---|---|

| Core Sector | Retail/Mixed-Use | Grocery-Anchored Retail | Healthcare Properties |

| Number of Properties | Over 190 | 117 | Over 230 |

| Geographic Distribution | Canada | U.S. (East, Midwest) | Global |

| Current Dividend Yield* | 5.9% | 10.68% | 12.0% |

| Occupancy Rate | 97.8% | 94.2% | 96.1% |

| Main Advantages | High occupancy, stable rent growth | Defensive assets, high dividend yield | Global diversification, economic resilience |

| Primary Risks | Market concentration, retail reliance | High leverage, valuation discount | High financial leverage, stock volatility |

*Dividend yield is calculated based on monthly distributions and NAV; rates may vary monthly.

Why Do REITs Provide Such High Dividends? How Are They Different from Direct Real Estate Investment?

If you’ve ever invested in real estate or managed rental properties, you might know that annual rental returns for individual housing investments typically range from 2% to 4%. Additionally, property management often requires significant time and effort.

REITs, on the other hand, can deliver attractive dividends even after deducting management costs. This is primarily due to their use of multiple financial instruments, such as leveraging, debt management, and refinancing, to boost returns. In contrast, individual investors generally rely only on bank mortgages—a relatively safe but limited financing tool.

While REITs offer higher returns, they also come with additional risks. These risks must be carefully evaluated when selecting REITs for investment.

How to Choose the Right REIT for Investment?

- Clarify Your Investment Goals: Decide whether you prioritize high dividend yields, asset appreciation, or regional economic stability.

- Assess Financial Health: Examine metrics such as leverage levels and dividend sustainability to choose financially stable REITs.

- Consider Industry Outlook: Research the demand trends in the REIT’s sector. For example, healthcare properties are highly resilient, while retail properties may face competition from e-commerce. If you are familiar and confident in a particular field, focusing on that sector can be a wise choice.

Don’t Just Look at the Benefits; Focus on the Risks!

RioCan Real Estate Investment Trust (TSX: REI.UN)

Despite its prominent position in the Canadian real estate market, RioCan faces several challenges:

- Staff Reductions and Efficiency Improvements:

- Layoffs: In October 2024, RioCan reduced its workforce by about 10% (approximately 50 employees) to improve operational efficiency. While this move incurred a restructuring cost of $9 million CAD, it is expected to save approximately $8 million CAD annually in cash expenses.

- Suspension of New Projects: RioCan has paused new mixed-use property developments to control costs and optimize the value of existing assets.

- Stock Price Volatility and Valuation:

- Performance: Over the past five years, RioCan’s stock price has fluctuated by about 36%, making entry points and holding costs critical for investors.

- Valuation: Currently trading at a price-to-earnings ratio of around 10.5x, which is below its long-term average, reflecting cautious market sentiment about its growth prospects.

- Dividend Policy:

- Adjustments: In 2021, RioCan cut its cash dividend by one-third due to the pandemic. While its financial situation has since improved, investors remain watchful of its dividend sustainability.

- Market Environment and Leasing Trends:

- Retail Challenges: Despite the impact of e-commerce on the retail real estate market, RioCan’s retail properties report a high occupancy rate of 97.8%, demonstrating some market resilience.

- Rental Growth: New lease agreements saw a 24.2% rent increase, while renewals rose by 12.6%, indicating strong pricing power.

Slate Grocery REIT (TSX: SGR.UN)

Despite its defensive portfolio, Slate Grocery REIT is facing the following challenges:

- Stock Price Decline:

- Since April 2022, unit prices have fallen approximately 33%, from around $15 CAD to about $10 CAD.

- High Debt Levels:

- As of September 30, 2024, Slate’s total debt was approximately $1.36 billion CAD, with a debt-to-equity ratio of 136.14%, indicating significant financial leverage.

- Interest Rate Risks:

- While 94.2% of its debt is fixed-rate at an average rate of 4.4%, the current high-interest-rate environment may increase refinancing costs and impact profitability.

- Market Valuation Discount:

- Units are trading at approximately 70% of their book value, reflecting cautious investor sentiment toward its asset valuation.

- Dividend Sustainability:

- The current yield of about 10.68% may indicate market concerns over the sustainability of its high dividends.

NorthWest Healthcare Properties REIT (TSX: NWH.UN)

While its defensive portfolio is appealing, NorthWest is grappling with these issues:

- Financial Leverage and Debt Management:

- High Leverage: As of September 30, 2024, NorthWest’s high debt levels may constrain its financial flexibility.

- Debt Refinancing: In October 2024, NorthWest announced it had extended the maturity of some 2025 debts and was advancing asset disposal strategies to manage upcoming maturities and reduce leverage.

- Dividend Adjustments:

- Reduction: In December 2024, NorthWest cut its per-unit dividend to $0.03 CAD (annualized to $0.36 CAD), reflecting a more cautious financial approach.

- Stock Price and Valuation Pressures:

- Decline: Over the past year, NorthWest’s stock price has seen significant declines, likely influenced by high leverage and dividend cuts.

- Valuation: The market’s cautious outlook on its growth and profitability has added downward pressure on its valuation.

- Operations and Portfolio Management:

- Asset Sales: To reduce debt, NorthWest is pursuing non-core asset sales to optimize its portfolio and improve financial health.

- Global Diversification: Although it owns healthcare properties across multiple countries, regional market dynamics and regulatory environments may pose operational challenges.

Conclusion

Investing in REITs allows small investors to participate in the real estate market, enjoying rental income and asset appreciation. However, each REIT comes with distinct risks and returns. RioCan is a leader in retail real estate but faces market concentration risks; Slate Grocery REIT offers defensive assets and high dividends but has high leverage concerns; NorthWest Healthcare Properties REIT benefits from a stable healthcare portfolio but struggles with financial pressure.

For risk-averse investors, diversifying across REITs or investing in balanced REIT ETFs might be a better option. Options like Canadian Net REIT (NET.UN.CA), iShares S&P/TSX Capped REIT Index ETF (XRE.CA), and BMO Equal Weight REITs Index ETF (ZRE.CA) are worth exploring.

Most REITs are eligible for registered Canadian tax accounts like RRSP, RESP, RRIF, and TFSA. Investors should evaluate dividend yields, asset quality, and industry prospects based on their risk tolerance and financial goals to make informed decisions.

For Canadian investors, platforms like Wealthsimple enable easy and cost-effective REIT and ETF investments with no trading fees. Regular, small-scale investments can help average out holding costs over time and reduce market timing risks.Let’s both get $25 when you fund a Wealthsimple account. Use my referral code: EG5JMW 🎁 T&Cs apply. Click here to open a Wealthsimple account and claim your $25 bonus.